Reduce Your Risk of Fines with BOI Reporting Support from a Skilled Business Attorney

Federal laws require businesses to comply with certain mandates to maintain transparency and prevent fraud. One requirement that many small business owners struggle with is submitting the Beneficial Ownership Information, or BOI filing. The BOI informs the government as to what individuals or entities own or benefit from the company.

The goal of BOI requirements is to provide transparency and eliminate money laundering, drug trafficking, terrorism, and other illegal activities. BOI reports include basic information about your company, including your legal name, your company’s name, the company’s address, and taxpayer identification number (TIN).

Let Lankford Law Help You File Your BOI Report

While submitting this information may seem simple, filing your BOIR to avoid fines and delays in starting or growing your company is crucial. The steps for filing a BOI often trip up business owners, leading to legal trouble that stalls their business’s growth. With our legal team by your side, you can have peace of mind in knowing that experienced business attorneys are supporting you in getting the BOI submitted thoroughly and in a timely manner.

Some steps involved in completing your filing include:

- Indicate the type of filing – Select whether you are submitting an initial report, correcting a prior report, or updating a prior report

- Submit the legal name of each person associated with ownership of the company, including first, middle, and last names

- Provide the business’s address, whether it is located in the U.S., in a U.S. territory, or a foreign country

- Include identifying numbers, such as the TIN

- Attach appropriate documentation as attachments, such as a U.S. passport or driver’s license. Clear, readable images are required for approval

What’s included in your BOI reporting service?

Our BOI reporting service offers detailed filing assistance to help ensure your report is prepared accurately and submitted on schedule. We’ll verify essential information with you and provide guidance to navigate each step of the filing process. Additionally, we’re here to support you with future updates should any changes in ownership or structure affect your filing requirements.

Do I need to provide any information or documents?

Yes, you’ll need to provide specific details about the ownership and structure of your business, as well as a unique identifying number, and you will need to issue jurisdiction from a valid identification document. This can include a U.S. passport, a state-issued driver’s license, an identification document issued by a state or tribal government, or a foreign passport if none of these are available. An image of the document showing this unique identifying number will also be needed. We will provide a checklist of the documents typically required for BOI reporting, and we’re here to answer any questions you have about this process. Rest assured, your information will be handled safely and securely under attorney-client privilege to help protect your confidentiality throughout the process.

What happens after you file the BOI report for me?

After we file your BOI report with FinCEN, we’ll provide you with a confirmation of the submission to keep for your records. If an account or FinCEN ID is required as part of the filing process, you’ll receive the login details so you can easily access or update your report in the future. Be sure to keep this record, as future changes in ownership or structure may require updates to your filing.

How often does this report need to be filed?

Beneficial ownership information reporting is not an annual requirement, meaning a report only needs to be submitted once. However, any changes to the information provided—such as updates to ownership or identifying details—must be reported to FinCEN.

Will you remind me when it’s time to update my BOI information?

Typically, business owners track their deadlines and time frames. However, we may offer reminder services to help keep you informed of upcoming deadlines or required updates. If you are interested in reminder services, you can meet with our business attorney to discuss how this would work.

Is my information kept confidential?

Yes, any information you provide is treated with strict confidentiality, as required by law. As your legal counsel, we maintain complete confidentiality under attorney-client privilege.

What if I’m not sure if my business needs to file a BOI report?

If you’re unsure, we recommend scheduling a consultation. We can discuss the details of your business and help you determine if filing is necessary based on current regulations. Our business lawyer can make arrangements to meet with you in your workplace so the initial consultation is as convenient as possible. Call today to schedule your case review.

Can you help with BOI reporting for multiple businesses?

Of course! If you have multiple entities, we can assist with the BOI reporting process for each one and help develop a tailored approach to meet each entity’s specific requirements.

What if I miss the filing deadline? Can you still help?

Yes, we can assist you even if you’ve missed the filing deadline. We’ll discuss your options and help you understand any potential penalties or steps to take if a deadline has passed.

How do I get started with your BOI reporting service?

Simply contact our office or fill out the contact form on this page to schedule an initial consultation. We’ll discuss your needs and explain how our BOI reporting services can assist you.

Important Filing Dates when Filing a BOIR

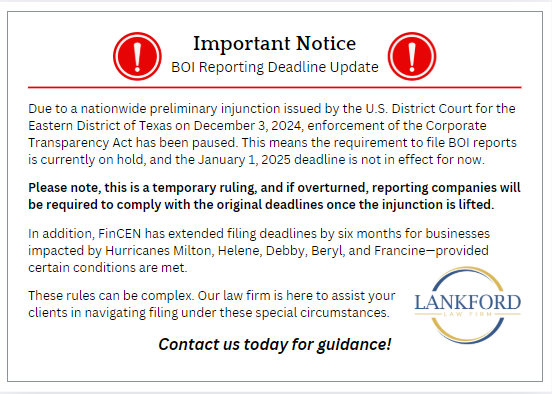

Timing is crucial when submitting reports to the government. Depending on when you formed your company, you may have a due date on a number of different days. For example, reporting companies formed before January 1, 2024, must be filed by January 1, 2025. Companies created in 2024 have 90 calendar days after receiving public notice or after the registration becomes effective. Reporting companies registered after January 1, 2025, have only 30 calendar days to file a BOIR following registration. Failing to comply with these requirements may result in hefty fines of up to $500 per calendar day.

Don’t risk fines that could eat into your company’s hard-earned profits. Contact our legal team for help submitting your forms on time and with the necessary information. Call 850-888-8992 to schedule your initial consultation today!

Call Us Now

Call Us Now Email Us Now

Email Us Now